How to become a bookkeeper no experience! in 2023

Content

If you enjoy working with numbers and are looking for a career that doesn’t require extensive training, you might consider taking a serious look at bookkeeping to see if it’s a field you might thrive in. Here’s an in depth look at how to become a bookkeeper, and what you can do once you earn the title. Self-taught bookkeepers use a variety of courses, seminars, books, and other online resources to learn about bookkeeping and accounting. You can also learn how to use accounting software, like QuickBooks, which can teach you about the basics of bookkeeping as well as the technology used by many businesses. A business must have bookkeeping processes and policies that keep company records up-to-date and accurate.

- They record transactions, enter them into a system and then reconcile the records with the bank statements when they come in.

- Department of Labor’s Occupational Handbook, some of the most in-demand accounting jobs include comptroller, accounting manager, senior tax accountant, and internal auditors.

- In a larger business they might work standard business hours in an office on-site; in a smaller company they might work a few days a week.

- There are high stakes when managing a business’s financial statements, which can lead to stress.

- The two careers are similar, and accountants and bookkeepers often work side by side.

- Not only does it improve your work ethic, but it also improves the relationship between you and the company you are working for.

Bookkeepers are also responsible for the accuracy of their company’s financial statements, which they prepare monthly or quarterly. There are many different programs out there that can help you get started on the right foot. Some programs even allow you to create books and track expenses and income. You’ll need some basic knowledge of how these programs work, but once you learn that, it will be easy for you to begin entering data into them daily. After getting an official certification, you can also choose to get a license to become a Certified Public Bookkeeper. This distinction opens up the highest tier of bookkeeping jobs and provides the best career prospects.

Attention to Detail – The Skills of a Good Bookkeeper

If you are interested in becoming an accountant, it may be beneficial to your career to become a certified public accountant (CPA), which has its own exam. You must have a minimum of 150 postsecondary education hours, or what amounts to a bachelor’s degree in accounting, and an additional 30 hours of graduate work. The median annual income for bookkeeping, accounting, and auditing clerks was $45,560 in 2021. However, the actual salary varies substantially depending upon factors such as location, level of education and experience, industry, and job responsibilities. For instance, bookkeepers in the finance and insurance sectors tend to earn more than those in other industries.

- It teaches you the essential skills to become a professional bookkeeper.

- As mentioned above, while bookkeeping doesn’t require a college degree, it does entail a specific set of skills in order to meet the basic requirements for employment.

- To become one, you have to either have worked at the IRS or pass an EA examination.

- A bookkeeper analyzes company financial statements but focuses more on the actual money movement and transactions to compile figures on money in and out.

- Most bookkeepers know a lot about accounting processes and procedures, which can help cut down on mistakes and improve the overall accuracy of financial data.

- There are many opportunities to work in a salaried position from home to gain on-the-job training.

- She’s on a mission to help job seekers ditch their daily commute in favor of telecommuting.

- Some of the key tasks for accountants include tax return preparation, conducting routine reviews of various financial statements, and performing account analysis.

These don’t require you to go to school or gain any special training, but they may be skills you’ll need to develop over time. Simply put, bookkeepers are responsible for all financial activity and oversight of a business. They record and organize financial statements, ensure compliance with important tax rules, and facilitate all ingoing and outgoing payments on specific business accounts. An undergraduate degree will take 2-4 years and can pursue higher-paying positions in the field than those without a credential. Professionals who learn through on-the-job training can grasp essentials after about six months in entry-level roles. Candidates looking at how to be a bookkeeper without a degree can follow several paths.

Search Programs Offering Bookkeeping Majors

People often confuse bookkeepers and accountants—and with good reason. While there are certain similarities and overlaps between the two, there are distinctions that set these two roles apart. Bookkeepers don’t necessarily need higher education in order to work in their field while accountants can be more specialized in their training. Because bookkeepers tend to work for smaller companies, they may not be paid as much as accountants. Knowing the differences between the two can help people find their niche in the industry and can give guidance to companies on who to hire for their needs. Bookkeepers who are interested in switching jobs but do not have a college degree might consider becoming an EA after a stint with the IRS.

- A degree is not required to be a bookkeeper but most employers like to see some form of continued education.

- A bookkeeper is a critical player in the financial management of a business.

- The great thing about becoming a bookkeeper is the room for advancement.

- University Headquarters (UniversityHQ) is your #1 resource for finding top rated colleges, scholarships, potential salaries and helping you find the right career.

- If you are serious about becoming a certified bookkeeper, I highly recommend taking the free online class the moms took FIRST to see if this profession is right for you.

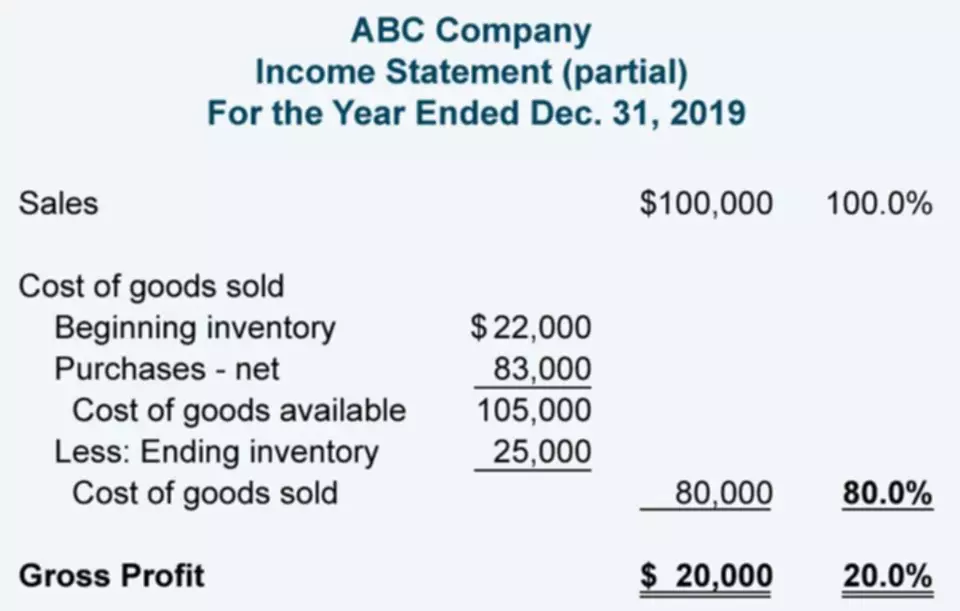

- Bookkeepers prepare bank deposits, financial documents, annual financial reports, and income statements.

- You can also learn how to use accounting software, like QuickBooks, which can teach you about the basics of bookkeeping as well as the technology used by many businesses.

- On the other hand, accounting is a broader field that encompasses bookkeeping tasks but also involves analyzing and interpreting financial data.

Their job is to advocate and assist taxpayers when they have issues with the Internal Revenue Service. To become one, you have to either have worked at the IRS or pass an EA examination. There are critical differences in job growth and salaries between the two. Growth how to get a job as a bookkeeper for accountants and auditors is expected to continue for the next several years. The Bureau of Labor Statistics (BLS) expects 6% job growth in this field from 2021 to 2031. As an accountant, you may have to crunch numbers, but those are not the only skills needed.

Summary: Online Bookkeeper Jobs Offer a Stable Opportunity to Earn An Above-Average Salary From Home

He’ll also give you the tools needed to start from scratch and grow to a thriving, independent bookkeeper regardless of your previous experience. Find out more about what bookkeepers need to be successful during the free discovery series at Bookkeepers.com. They both completed the training in 10 weeks, but it’s done at your own pace. However, having a certification can be helpful when you are building your client base. It shows potential clients that you have taken extra steps to serve their needs. Most courses range in length from seven to 14 weeks (if you take one session per week).

With bookkeepers, there are a lot of minutiae involved, and keen attention to detail is paramount. Accountants, on the other hand, tend to use the bookkeeper’s inputs to create financial statements and periodically review and analyze the financial information recorded by bookkeepers. We’ve listed some of the key differences when it comes to the requirements and job market for each. Therefore, those who do not like math, get confused easily when making simple calculations, or are generally opposed to number crunching should not apply. Bookkeeping is a task that requires dedication and hard work and comes with its own set of stresses.

If you run a small business, you might have trouble with a complicated bookkeeping system that was made for bigger companies. On the other hand, more rigorous bookkeeping approaches are needed for large corporations. Bookkeeping is important to the financial health of any business, but it takes a mix of technical skills, organizational skills, and knowledge of financial laws.

Bookkeeping requirements also cover reconciliation, the process of comparing internal records with bank records to ensure there are no discrepancies. If you pursued a postsecondary degree or certificate, you will likely have career center resources to help you find a bookkeeping job. These https://www.bookstime.com/ offices may have particular insights about companies and roles in their area. At the same time, the number of predicted bookkeeping job openings per year over that period is 197,600. Compare this to the expected 136,400 annual openings for accountants and auditors (BLS, September 2022).

Bookkeepers Ensure the Accuracy of Financial Records and Transactions – The Benefits of Hiring a Bookkeeper

Bookkeepers play an integral role in managing the financial resources of many businesses. Figuring out what kind of degree to get can be hard, and you need to think carefully about your personal and professional goals. When you want to become a bookkeeper, communication skills are just as important as technical skills because you will talk to clients daily. So, applicants must be able to talk and write clearly and use tact and diplomacy when dealing with difficult situations between clients and their business partners or colleagues.

Can you make good money as a bookkeeper?

The amount that you can earn as an entry-level bookkeeper will, of course, vary as it does within most roles, depending on things such as experience. According to Salary.com, the average salary is $45,626 for those who work as a bookkeeper full-time.

It’s about helping companies to grow by keeping track of their finances. A bookkeeper analyzes company financial statements but focuses more on the actual money movement and transactions to compile figures on money in and out. This is usually detailed by services such as receipts, invoices, sales, payroll, and credit card statements. Modern bookkeepers generally leverage accounting software to centralize all financial processes and automate some services to increase efficiency.

Accountants and bookkeepers work with numbers and financial data all day long. How much you make as a first-year accountant depends mainly on the specific career path you pursue. While accounting can be a lucrative long-term career, most accountants, unlike corporate attorneys or investment bankers, do not command huge salaries during the first few years. There are various career paths for accountants (and some for bookkeepers), from working as a forensic accountant to becoming a financial auditor or an enrolled agent.

How do I start off as a bookkeeper?

- Pursue a high school degree. Unlike accountants, many bookkeepers have associate's or bachelor's degrees.

- Acquire training.

- Apply for positions.

- Become a freelancer.

- Consider certification.

In a larger business they might work standard business hours in an office on-site; in a smaller company they might work a few days a week. A bookkeeper who is self-employed running her own bookkeeping business may take on a broader range of duties than their peers. They will likely have to track their own finances including income and expenses, for example. They will also be required to make their own tax payments and make sure their business remains in compliance with local and state law. Completing a course can increase your knowledge of bookkeeping, but to prepare for a career, go for the certification so you can obtain the license. You’ll have the CPB credential to add to your credibility as you pursue jobs or start your own virtual bookkeeping business.

Bookkeeping vs. Accounting: An Overview

Understanding this job’s scope and the tasks accompanying it will help you decide if it’s a good fit for you. Once you’re confidant that you have a solid base of bookkeeping skills, you’ll be ready to create a resume and find your first paying position. If you need help with your resume, you can call or visit the nearest state unemployment office, where they will help you create a professional resume that reflects your skills and talents. Almost every business — large and small — benefits from the services of a bookkeeper. While there aren’t specific companies that routinely hire bookkeeping candidates, almost any remote-friendly company will, at some point, have the need for a bookkeeper.

No hay comentarios